Renting Experiences Revealed: Deposit Protection Trends in the UK Rental Market

Marks Out Of Tenancy has analysed over 2,299 rental property reviews from 2017 to 2025, revealing how tenant experiences have evolved across the full rental spectrum - from budget flats to luxury homes. The study highlights changing satisfaction levels, shifting platform usage, and the impact of events like COVID-19, uncovering clear seasonal, geographic, and demographic trends. By including all property types and rent levels, the analysis offers an insightful picture of the modern rental market.

Whether you're renting your first home, managing a portfolio of properties, or researching the evolving landscape of the UK's private rental sector, understanding deposit protection trends is crucial. Our data has unveiled significant insights, highlighting variations driven by policy, market behaviour, and platform adoption.

Deposit Protection – Why It Matters

In the UK, securing tenant deposits via government-approved schemes is not just best practice - it's a legal requirement designed to safeguard renters and maintain trust between tenants, landlords, and agents. Despite these regulations, the reality of compliance and awareness across the market can vary significantly.

In the UK, there are three main government-approved TDP schemes: the Deposit Protection Service (DPS), MyDeposits, and the Tenancy Deposit Scheme (TDS). In Scotland and Northern Ireland, separate government-approved schemes operate, including SafeDeposits Scotland and TDS Northern Ireland.

To find out more about your rights as a tenant and landlords’ legal obligations when it comes to deposit protection, take a look at our guide to rental deposits.

What the Data Tells Us

Marks Out Of Tenancy analysed comprehensive data spanning diverse rental experiences from budget-friendly accommodations to luxury properties. This inclusive approach reveals compelling findings:

Overall Deposit Protection Rates:

- Approximately 69% of reviewed properties reported protected deposits.

- A surprising 31% indicated either their deposits were unprotected or the tenants were unaware of their protection status.

These numbers reveal a real lack of awareness, showing there's a big opportunity to improve education for tenants, landlords, and letting agents.

Annual Trends – A Window Into Market Dynamics

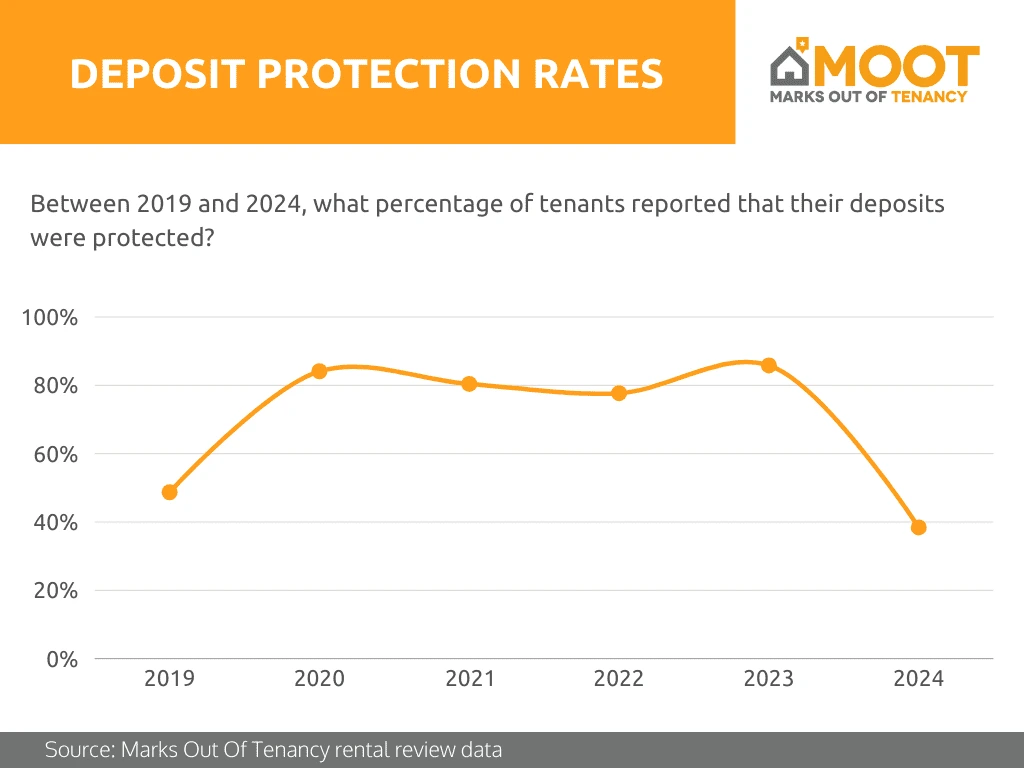

Deposit protection adherence fluctuates notably by year:

- 2019 showed a significant lower deposit protection rate at approximately 49%.

- 2020 and 2021 saw a sharp rise to over 80%, likely influenced by increased awareness and shifting practices amid the COVID-19 pandemic.

- However, 2024 witnessed a notable drop to just 38%, raising questions around recent market behaviours or policy enforcement effectiveness.

These changes highlight the need for ongoing awareness and strong enforcement to make sure rules are followed and tenants feel confident and protected.

Geography Matters

Regional insights reveal distinct trends, suggesting varied enforcement and cultural attitudes towards deposit protection:

- Nottingham led with an impressive 89.3% compliance rate, paired with higher tenant satisfaction scores.

- Other notable performers include Fife (85.6%) and Bath and North East Somerset (80%).

- Lower protection rates in areas like Tower Hamlets (80.9%) also correlated with reduced tenant satisfaction, highlighting a critical relationship between deposit security and tenant experience.

What It Means For You

- Renters - It is your right to have your deposit protected. Gain clarity on your rights to better advocate for deposit protection.

- Landlords and Agents - Identify benchmarks, understand regional compliance expectations, and improve practices to foster trust and satisfaction, and avoid penalties.

- Researchers and Policy Makers This kind of data can help shape better laws, smarter enforcement, and more targeted awareness campaigns.

Taking Action

Understanding these patterns is the first step towards a healthier rental market. For tenants unsure of their deposit status, tools like the Deposit Protection Service can confirm protection status. Landlords and letting agents can engage proactively in deposit schemes, not only to ensure compliance but also to enhance their reputation and tenant satisfaction.

By recognising and addressing these trends, we collectively work together to create a more transparent, trustworthy, and equitable rental market